I’m going to answer that question in this first sentence–your mailbox! That is absolutely the place to look for your best credit offers, and I don’t mean new credit offers. Your best offers will be from your current credit card banks. There are two main reasons for this: (1) You already have a relationship with these banks. They know how you handle your credit, so they can predict the profitability of making you an offer. (2) It costs the bank less money to get business from existing customers than to find new people. All we have to do is know how to take advantage of these offers in a way that we win.

I receive excellent offers every day because I have 50+ credit cards. I know some people may say, “Scott, you’re going to get in trouble with all this credit,” and my response is, “it’s not the credit that will get me in trouble, it would be the spending!”

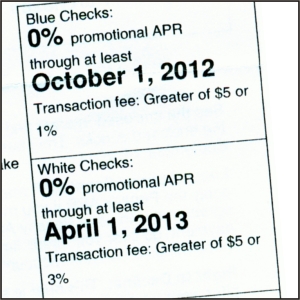

Let’s take a close look at the above offer I just received from my Barclay Card. This offer came with a cover letter that included the details of the offer as well as more specifics on the reverse side, plus four checks (blue and white) that I can write out to whomever I want. It is largely do to offers like this one that I’ve not only been able to borrow money at 0% for more than 15 years, but also have been able to earn money from my credit cards.

There are two options to this deal: (1) Blue Checks: 0% for 12 months with a $5 or 1% transaction fee; and (2) White Checks: 0% for 18 months with a $5 or 3% transaction fee. After the promotional APR (Annual Percentage Rate) ends, the rate jumps to 15.24%. I can write the checks to whomever I want (except Barclays Bank) and for any purpose, as long as I act on or before December 5th. (The offers are 12 months and 18 months because I received this in September and can start as early as October.)

STRATEGY #1: Start with a $0 balance before using the offer.

It is best to be able to use this offer for the entire credit limit ($12,500 in my case). That’s because if you have a current balance then it’s probably at a higher interest rate (say 15.24%). If you use this offer when you have an existing balance, there will be two rates, one at the offer rate of 0% and the other at 15.24% on the existing balance. The bank is supposed to apply payments to a high interest rates first, however, there are many loopholes that can allow them to put some of the payment toward the 0% rate first and thus locking in the balance at the high rate for the length of the 0% offer.

STRATEGY #2: Write the check to yourself.

Only write one check–to yourself. And deposit that in your checking account. There are two main reasons for this: (1) The offer only came with a couple checks; and most importantly (2) You can write checks from your checking account to whomever you like, even to the bank that sent the offer! That’s important because according to the offer rules (see the back), you cannot write their checks to pay down an existing account with their bank.

One more important note: NEVER make a late payment when you use a balance transfer offer. The bank always includes terms, in the offer, that state that if you’re late, the bank can not only raise the rate, but raise it to a penalty rate. NEVER EVER make a late payment!

Now that we have the strategy down, it’s time to do a little math to see what these offer actually cost. They promise 0% however, they certainly are not 0% because of the the upfront transaction fees.

OFFER #1: 0% for 12 months with a $5 or 1% transaction fee (blue checks).

I want to be able to use the maximum amount of money at 0%, so the question I have to answer is, “What is the maximum amount of the check such that that amount, plus the 1% transaction fee, will not go over the $12,500 credit limit?”

Let’s say P is the maximum amount of the check then:

P + 0.01(P) = $12,500

P(1.01) = $12,500

P = $12,500/1.01 = $12,376.23

Let’s check that…

The fee is 1% of $12,376.23, which is $123.77.

$12,376.23 + $123.77 = $12,500.00 (Perfect)

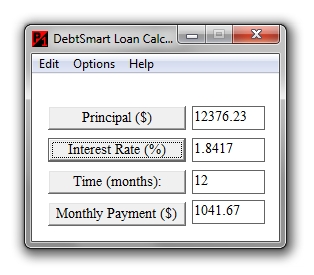

Okay, so I write myself a check for $12,376.23, BUT I have to pay back $12,500 within 12 months at 0%. The monthly payment to do that is simply $12,500/12 = $1,041.67 per month.

The next question is, “What is the APR for a $12,376.23 loan that is paid back in exactly 12 payments of $1,041.67?”

I can do this calculation by hand, but it’s a little messy so I used the DebtSmart Loan Calculator.

The answer is: 1.84%

In summary, the blue check offer of 0% for 12 months with a $5 or 1% transaction fee is, for my credit limit, really 1.84% APR.

OFFER #2: 0% for 18 months with a $5 or 3% transaction fee (white checks).

I want to be able to use the maximum amount of money at 0%, so the question I have to answer is, “What is the maximum amount of the check such that that amount, plus the 3% transaction fee, will not go over the $12,500 credit limit?”

Let’s say P is the maximum amount of the check then:

P + 0.03(P) = $12,500

P(1.03) = $12,500

P = $12,500/1.03 = $12,135.92

Let’s check that…

The fee is 3% of $12,135.92, which is $364.08.

$12,135.92 + $364.08 = $12,500.00 (Perfect)

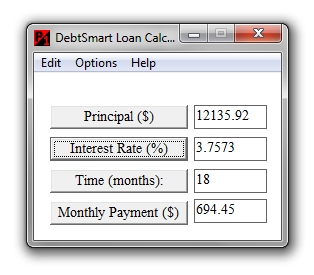

Okay, so I write myself a check for $12,135.92, BUT I have to pay back $12,500 within 18 months at 0%. The monthly payment to do that is simply $12,500/18 = $694.45 per month.

The next question is, “What is the APR for a $12,135.92 loan that is paid back in exactly 18 payments of $694.45?”

I can do this calculation by hand, but it’s a little messy so I used the DebtSmart Loan Calculator.

The answer is: 3.76%

In summary, the white check offer of 0% for 18 months with a $5 or 3% transaction fee is, for my credit limit, really 3.76% APR.

CONCLUSION

It’s clear that the blue-check offer is superior at 1.84% APR as long as it can be paid back within 12 months. If more time is needed than the white-check offer isn’t too bad at 3.76% APR. It’s just important to understand that those are the real, comparable APR’s based on the conditions of each offer, payment amounts, and a $12,500 credit limit because you wouldn’t want to repay a current 2% APR loan with a 3.76% APR loan. The banks are betting you won’t do the math–I know you will because you’re DebtSmart. 🙂